👋 Hey everyone, welcome to the newsletter. I’m Hugo Rauch, and my goal is to help founders accelerate growth and fundraise successfully.

Summary:

How do startups raise money? 💰

Why use a SAFE? 🤔

Are SAFEs common? 📊

Key SAFE terms ✏️

How does it work? ⚒️

How to issue a SAFE? 📄

How many % do investors get? 📊

Free templates and resources 📃

💰How do startups raise money?

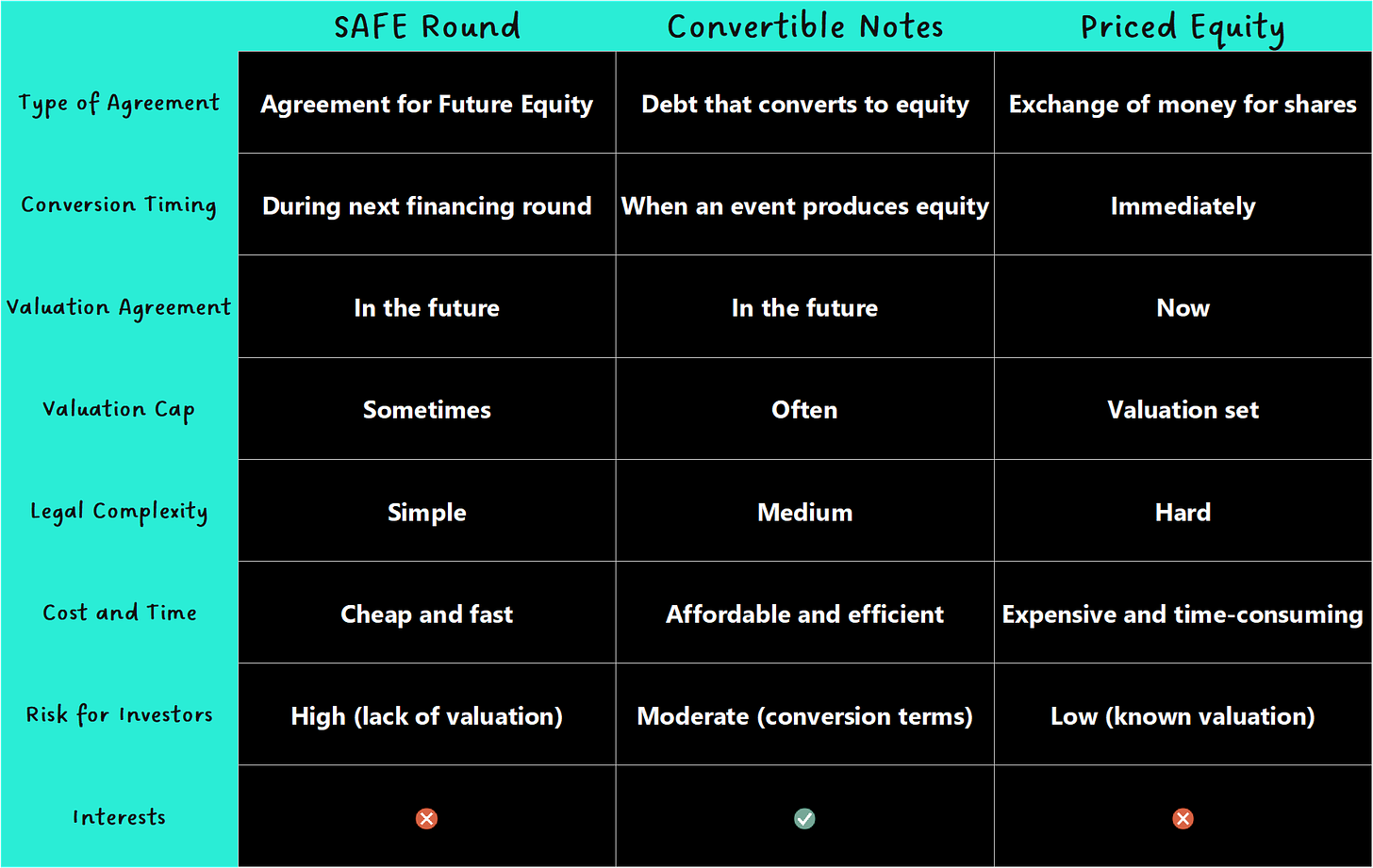

There are 3 common ways for startups to raise funds:

1. Priced Equity

Exchanging money for shares today at set terms.

In a priced round, investors come together to provide funding to the startup in exchange for shares that they receive immediately. This process involves negotiating a term sheet, determining the company’s valuation, and conducting legal due diligence.

2. Convertible Notes

A loan that converts into equity when a milestones is hit.

Investors loan money to the startup and are repaid with equity, usually at the next funding round. Convertible notes are rarely used today because of their complexity.

3. SAFE (Simple Agreement for Future Equity)

A contract allowing investors to receive shares in the future.

SAFEs are a promise. The investor receives a contract with the right to receive equity in the future, under specific terms. I’ll explain everything you need to know about SAFE, but first, here is a summary:

🤔Why use a SAFE?

Three key reasons early-stage founders prefer SAFEs:

1. Defers Valuation Discussion

SAFE notes allow startups to raise funds without needing to determine their company’s value today. Early-stage companies usually don’t have enough revenue to set a valuation. SAFEs delay this discussion until a future round.

2. Fast Process

You can close a SAFE very quickly, often within a matter of days depending on how prepared the startup and the investor are. This is because, again, SAFE doesn’t require a valuation to be set and are usually based on simple, standard templates, making legal review fast and easy.

3. Rolling Investment

Unlike priced rounds with a set close date, SAFEs allow investors to join at different times. This flexibility helps startups raise funds gradually, receiving one check at a time. Companies keep the SAFE open until they raise enough money or decide to close it. As a result, cash management is improved.

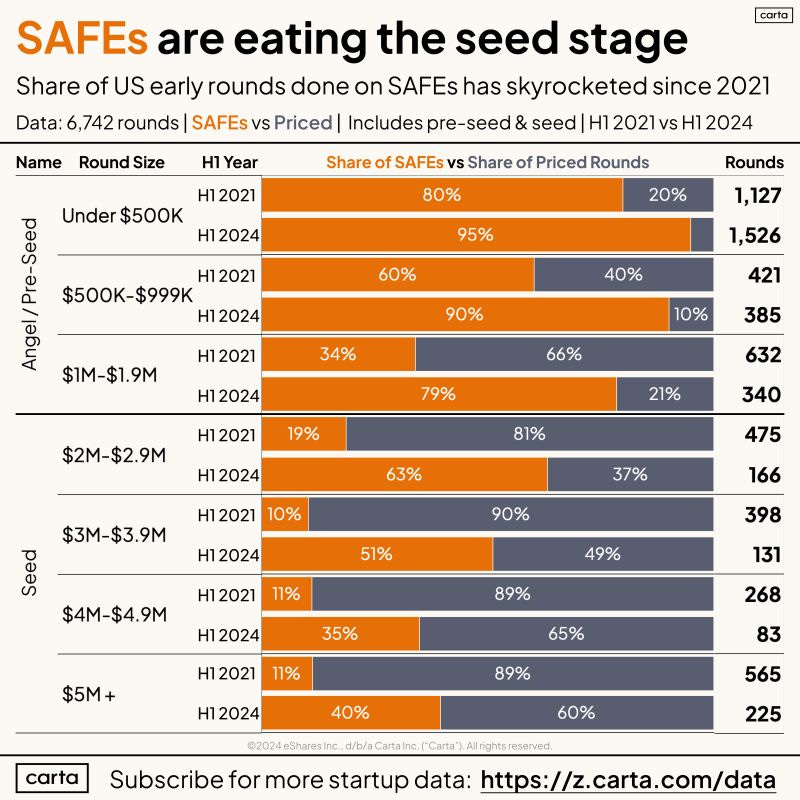

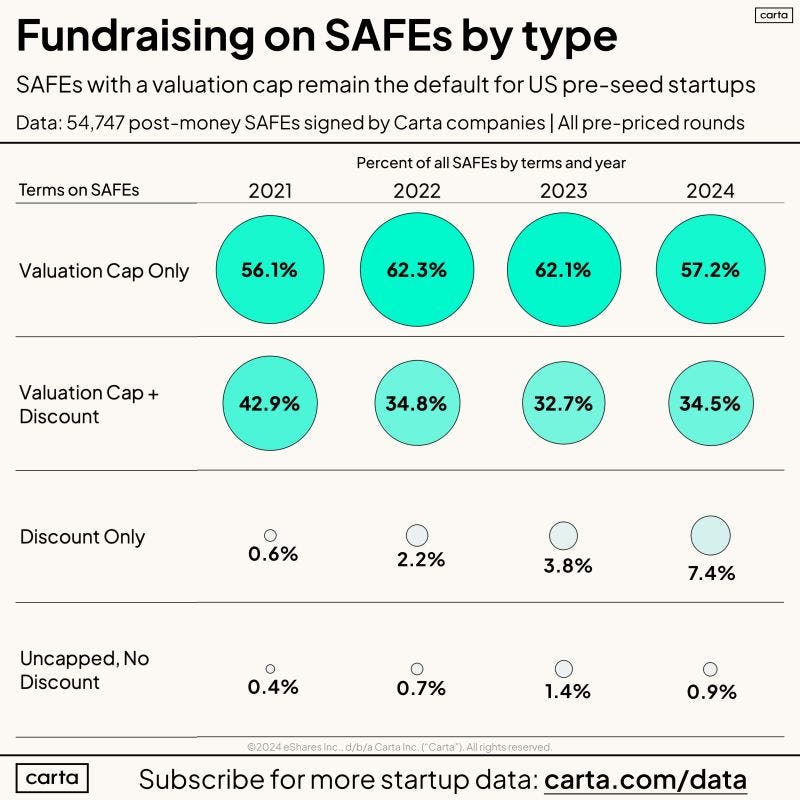

🤝Are SAFEs Common?

Y Combinator introduced the safe in 2013 to support early-stage founders in getting a first check. Since then, it has been used by almost all YC’s startups and has become the main instrument for early-stage fundraising. See it for yourself 👇

📍A small favor, I am starting my 🔴YouTube🔴 journey where you’ll learn alongside me as I become a venture capital investor, it’d really help if you could subscribe to the channel. Here's the link: How VCs Think.

✏️ Key SAFE Terms

“How will you calculate my share price?”

This is the main concern for investors when it comes to SAFEs. When investors join a SAFE round, they don’t know how many shares they’ll get until the SAFE converts.

Here are four key terms that help answer this question:

1. Principal

This is simply the amount of money the investor gives you. It’s a crucial part of the contract because it determines the size of the investment.

2. SAFE type

For an investor, the cheaper the shares, the better as they can buy more shares with the same investment. Here is two types of SAFE you must know:

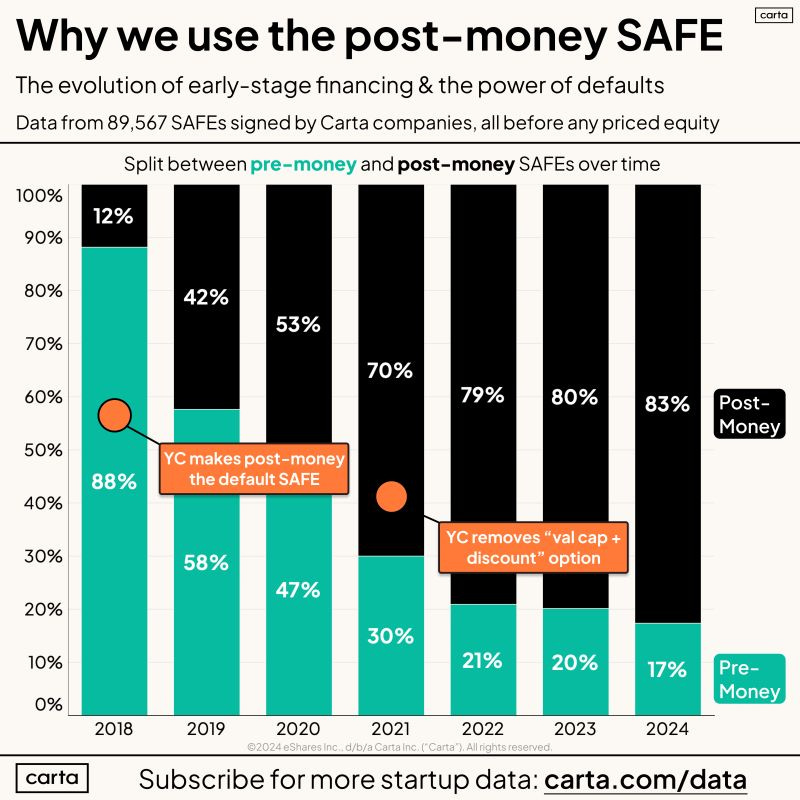

Pre-money vs Post-money.

Pre-money and post-money SAFEs determine when the share price is calculated and this timing has a significant impact on the number of shares an investor receives.

Pre-money: Valuation is determined before the investment is made. Under a pre-money SAFE, every new SAFE holder dilutes others.

Post-money: Valuation is determined after the investment is made. In a post-money SAFE investors lock in a certain percentage of the equity in relation to other shareholders.

As you can see on the graph below, post-money SAFEs are more popular.

3. Valuation Cap

A valuation cap sets the maximum price at which the SAFE converts to equity.

It is the most important terms in a SAFE because it directly affects how much equity early investors receive. The valuation cap is designed to reward those investors who take on the risk of backing a company in its earliest, riskiest stages.

While valuation caps are not required for SAFE Notes, they are often included.

Bear in mind that valuation caps, unlike a discount rate, are not guaranteed. If the next round’s valuation is lower than the cap, the cap becomes irrelevant.

4. Discount Rate

The discount rate gives SAFE investors a lower price per share than new investors. For example, if an investor has a 20% discount on a $1 per share priced round, they pay $0.80 per share. This makes the discount rate simpler than the valuation cap. The main difference here is that the discount rate always plays out, regardless of the valuation.

⚒️How does it work?

There are three key factors to understand in how a SAFE operates:

Conversion:

Investors provide funds upfront, but shares are issued later when a "trigger event" occurs. These triggers allow SAFE investors to become shareholders.

The two most common triggers are:

Equity Financing (Priced Round): When the startup raises a subsequent round of equity financing (e.g., Series A), the SAFE automatically converts into shares at either a discount or based on the valuation cap, whichever is more favorable to the investor.

Liquidity Event: This rarely happens but in the case of a liquidity event (acquisition or IPO), the SAFE converts into equity or cash.

Dilution:

When a startup raises funds, it creates new shares (≠ selling existing ones), which can dilute the ownership of current investors as the total number of shares gets bigger.

For example:

Current number of shares: 10,000, an angel investor owns 10% (or 1,000 shares) and you own the remaining 90% (or 9,000 shares).

You are now raising a new round and you agree to sell 20% to your new investor. The new total shares will be:

10,000 shares + 20% of the new total = the new total

10,000 shares = 80% of the new total

The new total = 10,000/80% = 12,500 shares

Angel investor's ownership drops from 10% (1,000 shares) to 8% (1,000/12,500).

Your new investors get 2,500 shares which equals 2,500 / 12,500 = 20% of your company.

Investor Rights

While SAFE notes tend to favor founders, investors can negotiate specific rights to safeguard their investment. Key rights may include:

Pro-rata Rights: This allows investors to maintain their ownership percentage by participating in future funding rounds based on their current stake from the SAFE notes.

Information Rights: This allows investors to gain access to important financial and operational details about the startup, ensuring they stay informed about its progress and can contribute to its development.

Liquidation Rights: In case of insolvency, SAFE notes often stipulate that the company must repay investors the amount they contributed before distributing any funds to shareholders.

📄How to issue a SAFE?

Once you have your investor lineup (you can use platforms like OpenVC to find them - use the code “EXPLORE” for a 20% discount, learn more here), it is time to draft the contract. Follow these steps:

1. Define the terms and create the SAFE

Choose a template from the resources section of this email and customize key terms, including the principal, valuation cap, and discount rate. Be sure to specify trigger events and investor rights.

Consult with legal counsel to ensure everything is defined and drafted correctly.

2. Get it sign and collect funds

Have investors sign the agreement as they commit to investing in your SAFE. After signing, collect the funds and record each SAFE note in your cap table. Transparency and proper documentation are essential to investors.

Pro tip: Carta offers a free cap table management software used by thousands of founders. This is not a partnership, I just like their free offer.

3. Convert to equity

When a trigger event occurs, convert the SAFEs to equity based on the agreed discount or valuation cap. Investors will then officially become shareholders. In the next section, we’ll explore the calculations behind standard SAFE notes.

📍A small favor, I am starting my 🔴YouTube🔴 journey where you’ll learn alongside me as I become a venture capital investor, it’d really help if you could subscribe to the channel. Here's the link: How VCs Think.

📊How many % do investors get?

As you've learned, there are two key terms to a SAFE from which you can build four different types of SAFE:

Cap, No Discount: Sets a maximum valuation but does not offer a discounted price per share.

Discount, No Cap: Provides a discounted price per share but lacks a maximum valuation.

Cap and Discount: Combines both a maximum valuation and a discounted price. Whichever is most favorable applies.

Most Favored Nation (MFN): Offers no cap and no discount, but allows the investor to receive the same terms as future investors if they are better.

Early-stage investors typically seek at least a valuation cap. Here is the distribution of the different clauses:

Let’s do some math:

Scenario 1: Cap, No Discount

In this case, the investor gets shares based on the valuation cap if it’s lower than the actual valuation at the next round. No discount is applied to the share price.

Example:

SAFE investment at Seed: $200,000

Valuation Cap: $5,000,000

Series A valuation: $10,000,000

Result: Since the cap is lower than the Series A valuation, the investor’s shares are priced based on the $5 million cap.

Ownership Calculation: $200,000 / $5,000,000 = 4% ownership

The investor receives 4% of the company's equity at the time of conversion.

Scenario 2: Discount, No Cap

The investor receives a discount on the price per share, without a valuation cap. They pay a reduced price per share compared to later investors.

Example:

SAFE investment at Seed: $100,000

Discount: 20%

Series A valuation: $8,000,000

Shares Outstanding: 1,000,000

Result: The investor’s shares are priced at 80% of the price future investors pay.

Ownership Calculation:

Price per share = $8,000,000 / 1,000,000 = $8

Discounted price = $8 × 80% = $6.40

$100,000 / $6.40 = 1.56% ownership

The investor receives 1.56% of the company's equity at the time of conversion.

Scenario 3: Cap and Discount

The investor benefits from both a valuation cap and a discount. They get shares based on whichever results the most favorable or in other words, the lower price per share.

Example:

SAFE investment: $300,000

Valuation Cap: $4,000,000

Discount: 15%

Next round valuation: $6,000,000

Shares Outstanding: 1,000,000

Result: The investor gets the better deal, which is the cap in this case.

Ownership Calculation:

Cap price per share = $4,000,000 / 1,000,000 = $4

Discounted price = 85% of $6/share = $5.10

Ownership: $300,000 / $4 = 7.5% ownership

The investor receives 7.5% of the company's equity at the time of conversion.

Scenario 4: Most Favored Nation (MFN):

The investor gets no cap or discount initially but can adopt better terms if later investors get more favorable ones, like a lower valuation cap.

Example:

SAFE investment: $250,000

No cap or discount initially.

Future investor gets a $5 million valuation cap in a subsequent funding round.

Result: The investor with the MFN clause can adopt the $5 million cap from future investors.

Ownership Calculation:

$250,000 / $5,000,000 = 5% ownership

The investor receives 5% of the company's equity at the time of conversion.

📃Resources

I've spent a lot of time researching to compile this article. Here’s a list of useful documents to help guide you through your SAFE round. 👇

If you found this helpful, please share this newsletter with another founder. Feel free to reach out with any questions!

Hugo 👋

Get in touch with me:

🔴 YouTube

🌐 LinkedIn

🗞️ Newsletter

🎧 Spotify - Apple Podcast

This is an outstanding article, Hugo! I'm learning so much from it right now! Thank you! Also, I'm super excited for your YouTube channel